Make Money, Make Sense

In which I try my best not to seem like I am a money expert because I am not. :D Yet.

Might as well to have been me, four years ago.

Working in the financial services industry has quite been the odd counter to my life -- which has been, for the lack of a better term, all about shopping. Until I became a member of the company I'm working for now and finally, finally realized that life isn't all about acquiring pretty things that please us, I was a madwoman for all things on sale and my closets were always bustling with too many clothes and shoes.

Like Jill, it took me a while to know that the way to being financially-free {a term meaning free of debt and can live comfortably} is a sound mindset that not everything should be bought.

That, and a lot of investing.

When I made my list some years ago, two of the items were related in making more money and making more sense out of it.

2. Create and not touch an emergency fund. CHECK

I always preach about building emergency funds and sure I have a bit of money lying around for rainy days, or you know, spontaneous I-only-have-30-minutes-to-be-on-the-airport trips, but it's not exactly the kind of account that can get me through if I ever decide to live somewhere random, like Sydney or .. Barcelona.

STATUS: I'm currently doing freelance web writing jobs so it can serve as my shopping money whilst my main income goes to the EF.

18. Earn 50% more than what I am earning now.

My lifestyle isn't exactly cheap and with automatic savings and investments coming out of it, it's imperative that I actively take steps into earning more. 50%, in my opinion and looking at my situation, is a realistic goal.

And with the kind of lifestyle, of which has already changed drastically over the last four years, my mind says that I'm making more money --- which means I have to make more sense of all these income. I've made some lists and here are the things that have been helping me achieve a more financially-fit lifestyle:

1. EQ / Emotional Quotient. The philosophy of spending is pretty much the same philosophy that applies on eating: Eat only when you have to, in delicate chews, and with grace. Sometimes you eat for pleasure, but not all the time. Plus, don't grab whatever's on the table.

When you get rid of your feelings of helplessness or your woe is me mentality, you'll have better emotional intelligence to resist the retail sirens. Clearly, you have to wrestle with your demons to find out why you act the way you do.

- Jill Sabitsana

2. Invest rather than spend. Oh, to spend without guilt! It has since become history as I've started to become more conscious of where I put my money. Paying for your MBA is considered an investment, and a dress worth Php 6,500, though relatively lower, is spending --- know which ones serve a bigger purpose, and which one can help you in earning more.

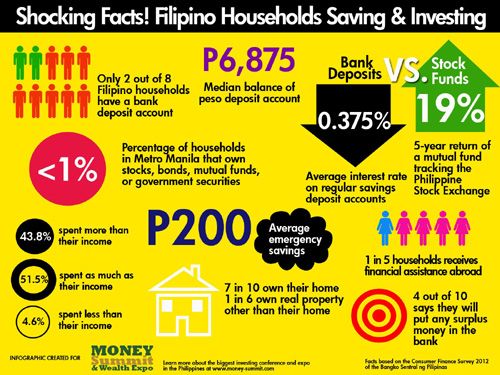

3. A little in the bank, and for everything else, invest. I made quite the reverse, by investing first and saving for emergency fund, second. Now that everything of that is fixed, I can safely say that don't keep everything in the bank, mutual funds and stock markets will make you gain the way no bank can't. MFs and UITFs offer an average of 6% and higher gains, a savings account is less than 1%.

Yes, really.

4. Stay off debt and credit cards.

I used to maintain a credit card which I paid off fully every month. While the credit card companies didn't earn a single dime from me and my prompt payments, I had to lay off the purchase trigger that was the credit card. I could've avoided some of the unnecessary purchases but I didn't --- because it was too easy to buy it, as I was sure I could pay it anyways. But I didn't have to, and that money could've gone somewhere else, somewhere it could earn, too!

5. That said, make saving and investing easy. The thing about keeping a portion of income is that it's pretty hard to transfer money or put them away for investments. But banks and credit card companies made it easy for us to pay our bills and spend! This is why I like BPI -- they really did make it easy for us to save {check their website for your options, if you're a client}. Then again, for investing, you can check out Sun Life Asset Management:) {my monthly investments are automated and I was quite shocked to realize I have a lot in there already!}

You don't think of retirement when you're retiring -- you save for it when you're young

6. If you're serious in finding out all the ways you can earn passive income, the seminars and workshops are all worth it. The thought of money talks, money workshops have seriously scared me way back. I imagine sweaty men trying to make the stocks go higher {I've seen the PSE trading room in the 90s, that is why} and fast forward to now, passive moneymakers {ergo men who know a lot about stock market, mutual funds and UITFs can still be pretty aggressive but with reason} are passionate in sharing how to get richer the safe and legal way.

As someone who has read statistics on how many percentage of the Filipinos are still borrowing from their relatives they get sick, it's painful to know that we all could've saved for the rainy days prior to getting sick. We could've saved for that college education {as stats show, not everyone finishes college nowadays}, and we could've saved up for that retirement instead of living with the grand kids.

There's something to be gleaned from Aya Laraya's talk --- and no, money seminars aren't full of sweaty men on a busy trading day.

Check out the next seminar of Pesos and Sense here.

7. Stay away from temptation. I already knew that my weakness was shopping --- so it was imperative that I stayed away from the malls at all costs except when I absolutely had to. It had been working out well, so far.

8. Account for everything that you spend on. I used to think taking note of every single expense I made was such a chore until I saw how much

a) I spent on shopping

b) on things I didn't need, just that I wanted them and I wanted to cheer myself up on a lonely afternoon

c) things I could've saved up on. Looking at my list back then made me want to scream at myself for having such low EQ and pushed me forward to make better spending choices and well, more money to save and invest. Here's a simple and {I hope} helpful Excel file of how I track my expenses which you can download and use here. Happy tracking!

9. Make a spending plan. Together with the things you have to spend on {ergo your daily needs}, take into account also the upcoming gastos such as your car's registration + change oil etc., your upcoming Japan trip, budget for Christmas gifts {I am saving for mine as early as now}, your trip to Europe next year, your child's school tuition, etc. It may seem daunting at first but knowing where you should allocate your money prevents you from blindly spending.

10. It's not how much you earn, it's how much you save. We Filipinos are guilty of this: We like whining that if only earned this much, we would be able to provide more for the family, we would be able to invest in ourselves, save up etc. But salaries will go up and if we have this mindset, it really will never be enough. Conscious saving and spending is key.

11. Read up on personal finance blogs. Some of my favorites are:

Local:

- Fitz Villafuerte's Ready to Be Rich

- Jill Sabitsana's Frugal Honey

- Lianne Laroya's Wise Living

- You Want to Be Rich

- Randell Tiongson's Life and Personal Finance

International:

Like my previous How to posts, I might be able to whip up some more of these {after all, personal finance management is my personal advocacy} but for now, that is all and hope you can let me know some of what helps you manage your money so I can use it for myself and help others, too!

xx